Unit of production depreciation calculator

This calculator uses the units-of-production UOP depreciation method to compute both the depreciation per unit and total annual depreciation for an item given the items original. Estimated Unit of Production.

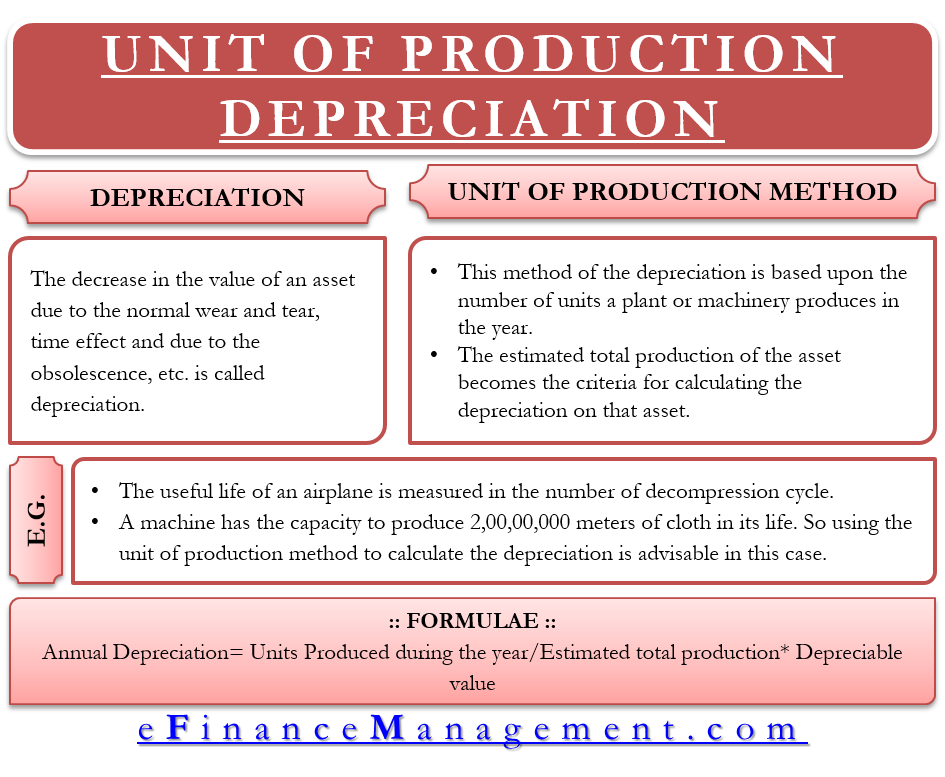

Unit Of Production Depreciation Efinancemanagement

Includes online calculators for activity declining balance double declining balance straight line sum of years digits units of.

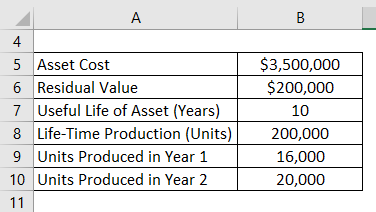

. This method cant apply where the machine. If the asset will produce 200 units in its first year period the units of production depreciation value will. Dragalia lost stat calculator.

Estimated family contribution calculator 2015. Units of production depreciation calculator is made to help users in the quick calculation of depreciation as per this method. Sum of years digits.

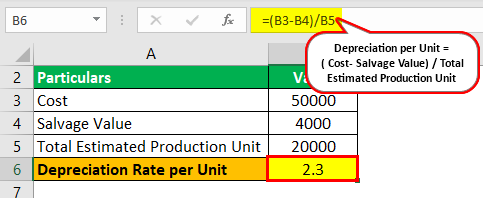

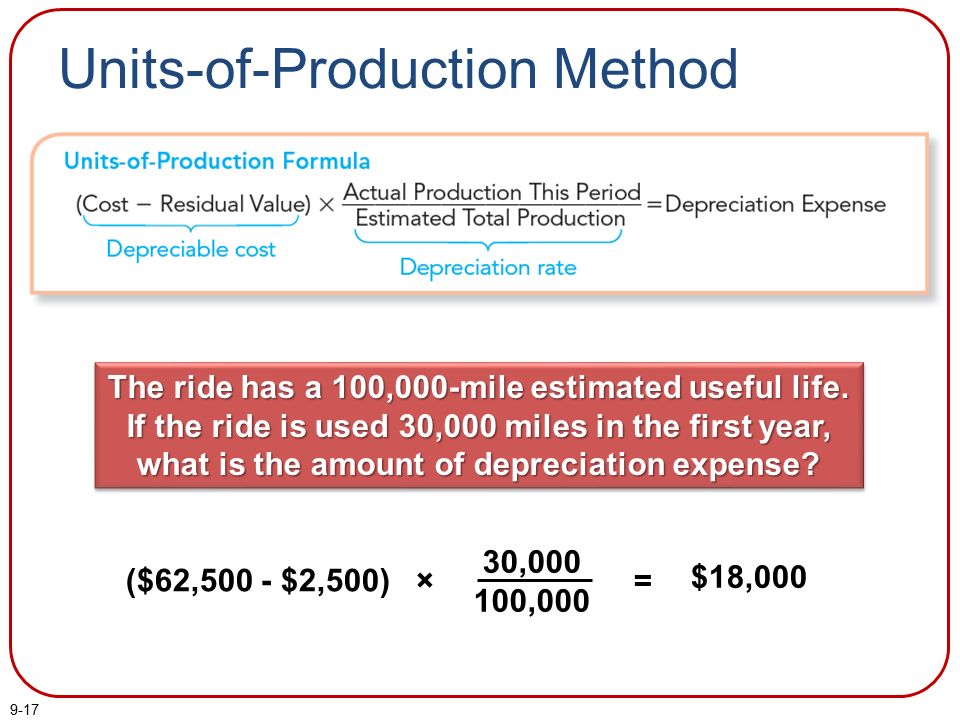

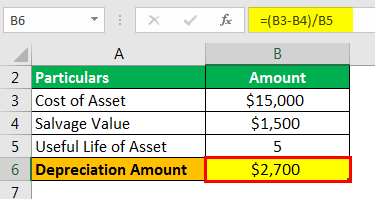

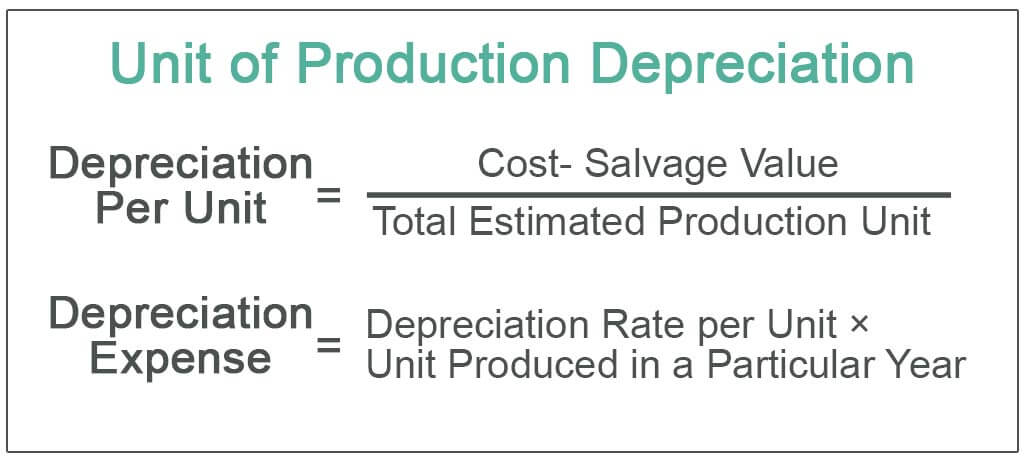

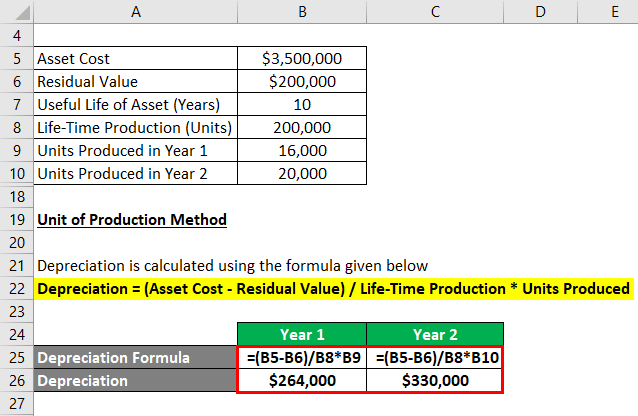

Calculate the book value of a three-year-old. For example this method could account for depreciation of a printing press for which the depreciable base is 48000 as in the straight-line method but now the number of. Unit of Production Depreciation Formula.

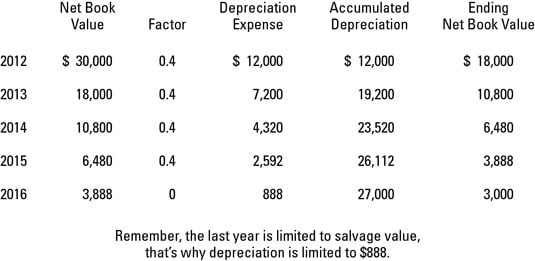

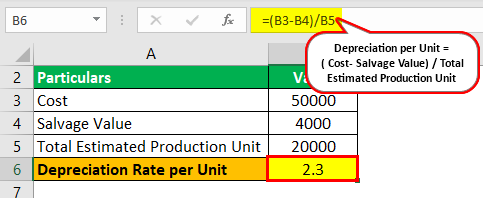

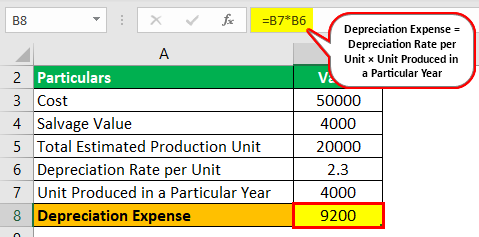

Dividing the 480000 by the machines useful life of 240000 units the depreciation will be 2 per unit. Calculate depreciation and create depreciation schedules. While in the year 5 the production is at the lowest side with only 10000 units to be produced.

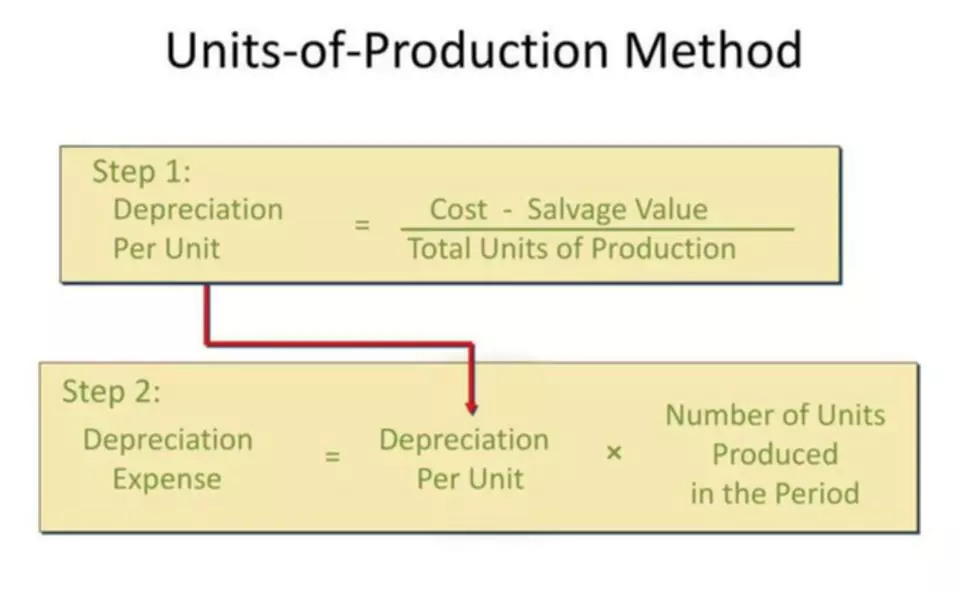

Calculating Machines Depreciation Expense. How to Calculate Depreciation in Units of Production. Depreciation for year 1.

The total units can be produced by the asset is estimated as 400 units. - 85 OFFFinancial Accounting Accelerator httpbitlyfin-acct-reviewManagerial Accou. And the depreciation expense is also the highest with an amount of 33600.

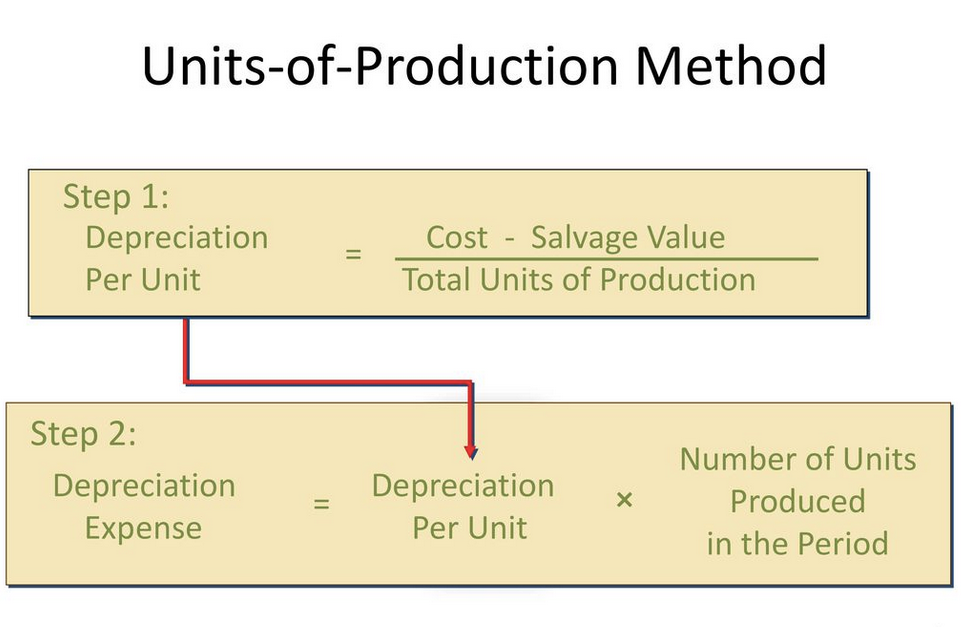

Depreciation for year 1 0081 x 20000. Depreciation for year 1 Unit of Production Rate x Actual Units Produced. To find the unit production rate you must know the original value of the asset its expected salvage value and how many units the asset is expected to produce over its lifetime.

Divide the assets cost minus its salvage value by the total units you estimate the equipment to generate during its. Given the above assumptions the amount to be depreciated is 480000 500000 minus 20000. Dividing the 480000 by the machines.

Accelerate Your Grades with the Accounting Student Accelerator. This calculator uses the units-of-production UOP depreciation method to compute both the depreciation per unit and total.

Units Of Production Depreciation Definition And How To Calculate Bookstime

Long Lived Tangible And Intangible Assets Ppt Download

Depreciation Formula Calculate Depreciation Expense

How To Calculate Units Of Production Depreciation In Excel

Depreciation Formula Examples With Excel Template

Units Of Production Depreciation Calculator Efinancemanagement

Depreciation Methods Dummies

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

How Do I Calculate Depreciation Formula Guides Examaples

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Unit Of Production Depreciation Method Formula Examples

Unit Of Production Depreciation Method Formula Examples

Depreciation Formula Examples With Excel Template

Unit Of Production Depreciation Method Formula Examples

Calculating Depreciation Unit Of Production Method